White Paper: Ditching AOBRD & Getting More From Your ELD

To download this white paper as a pdf click here: ELD Evolution-final-shortened.

For federally regulated truck fleets and drivers, the December 17, 2017, deadline to implement electronic logging devices (ELD) brought big changes to long-held operating procedures.

The most obvious: no more handwritten paper logs.

Today, motor carriers and drivers who are legally required to maintain records of duty status must use one of two types of electronic devices: a self-certified ELD that’s registered with the U.S. Federal Motor Carrier Safety Administration, or an Automatic Onboard Recording Device (AOBRD) that was installed in the vehicle and in service prior to December 17, 2017.

These “grandfathered” AOBRDs can be used until December 16, 2019, after which only compliant ELDs are permitted.

Unlike paper and electronic logs, the differences between compliant ELDs and other onboard recorders aren’t necessarily apparent. Drivers and carriers routinely use the term “ELD” to describe any electronic device that can log hours of service, including AOBRDs that don’t meet all the requirements.

One situation where you can tell the difference between a legal ELD and an AOBRD is during a roadside inspection.

By rule, an ELD must be able to compile data into a standard comma-delimited (CSV) file that enforcement officers can transfer to theirvice via telematics or a “local” connection like a USB drive or BluetootIf your electronic log doesn’t have these capabilities, it’s not a compliant ELD. And you’ve probably heard about it from inspectors because of the extra steps they need to take in order to check your drivers’ duty-status records.

Another place you can tell the difference is in your fleet’s back office.

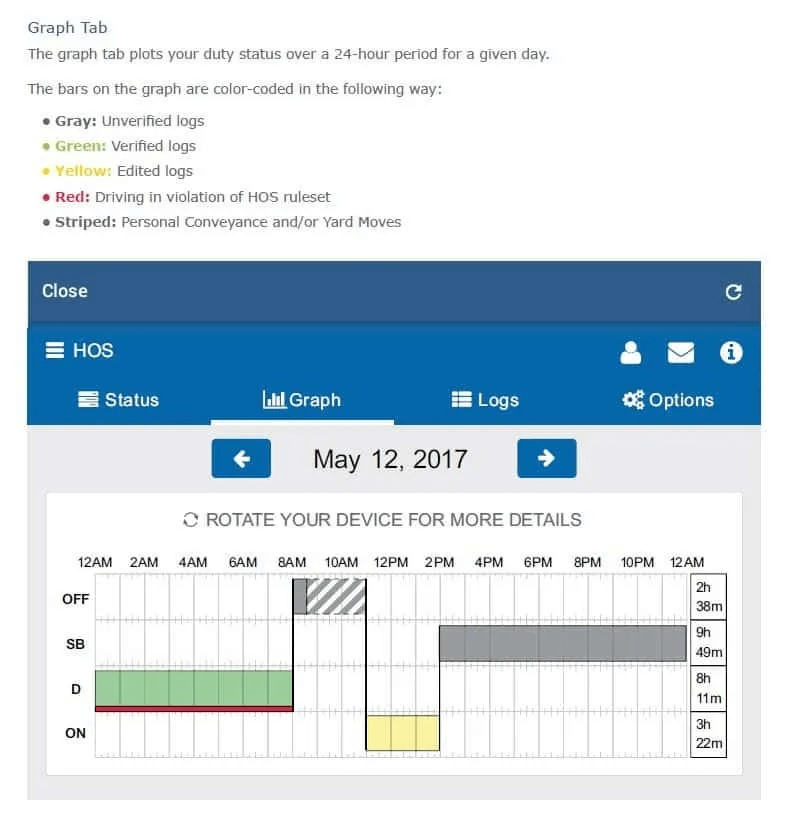

A compliant ELD synchronizes with the engine’s electronic controls to record the date and time; engine hours; vehicle miles; and the identification of the driver, vehicle, and motor carrier. It must have GPS capabilities in order to log the vehicle’s location whenever the engine powers up and shuts down; at least once an hour when the vehicle is in motion; and any time the driver changes duty status or makes a “personal use” or “yard” move.

GPS allows the ELD to automatically record driving time when the vehicle is traveling at least 5 m.p.h., and to default to “on duty, not driving” status when the vehicle is stopped for five minutes with no interaction from the driver.

Unlike an AOBRD, an ELD must provide a way for the driver to review, edit, and annotate records of duty status. The only things a driver can’t change are data that’s captured automatically and driving time. Limited editing rights, coupled with the ability of the driver and motor carrier to annotate, help ensure that records are accurate.

These and other technical specifications are written into the regulation governing hours of service (49 CFR §395). There are no such requirements for AOBRDs.

Many Options. Which One is Best?

While there are dozens of ELDs on the FMCSA’s list of registered devices, they all have to produce the same basic set of data, which makes managing compliance simpler and more cost effective.

These benefits are magnified if the device has telematics and can communicate duty status and other information about the driver, vehicle, and load that you can incorporate into a digital workflow.

How do you find the right ELD for your trucking operation?

There are plenty of resources available, including an entire section of the FMCSA web site (eld.fmcsa.dot.gov) with official information about the ELD rule and which devices are approved and certified for use.

As the leader in enterprise mobility and workday management technology for the trucking industry, Transflo is uniquely positioned to help fleets and drivers leverage ELDs to streamline the way they manage scheduling, documentation, compliance, and other business processes.

As you evaluate your use of electronic logs, we’ve identified three important areas to consider in order to maximize the benefits of ELDs.

1. Telematics

Some ELDs are more capable than others but the rule is clear: they all must meet the same minimum technical specifications for collecting, compiling, and communicating information about a driver’s record of duty.

The intent is to make hours-of-service enforcement easier and more consistent across the country. To do this, it has to be as fast and easy to share electronic data with inspectors as it was with paper logs.

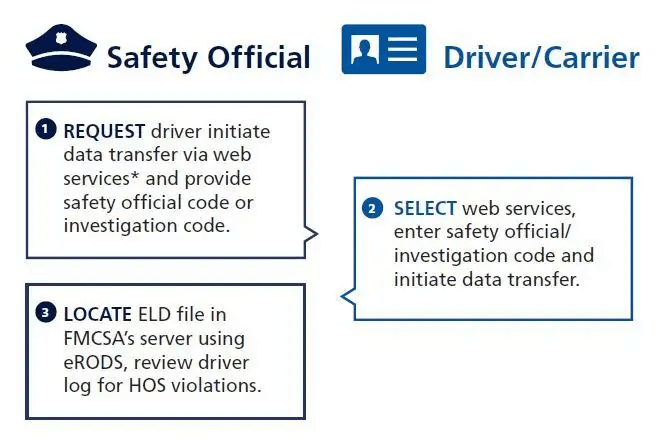

During an inspection, an ELD must be able to automatically produce a CSV file with a record of the driver’s current 24-hour period and the previous seven consecutive days. There are two ways for a compliant ELD to transfer files to inspectors:

– Telematics, where the file is uploaded to a secure FMCSA server or sent by email

– Local transfer using Bluetooth or a USB drive

Telematics is the FMCSA’s preferred method for transmitting data. This wireless, “web-based” transfer eliminates the extra steps and security risks associated with pairing devices over Bluetooth or exchanging USB drives.

An ELD with telematics can also provide a stream of data about the truck, driver, and load whenever the device is connected to a wireless network. It’s invaluable for any business that wants to reduce its use of trip sheets and other paperwork in favor of a digital workflow.

2. Access to Data

One thing has not changed from the days of paper logs: motor carriers must be able to provide six months of ELD records during an audit with documents to verify their accuracy. These documents can include:

– Bills of lading or invoices that show the start and ending location for each trip

– Dispatch records or trip reports

– Expense receipts (meals, lodging, fuel, etc.)

– Records from electronic communications and dispatch systems

– Payroll records or settlement sheets

A valid supporting document for hours-of-service compliance must include the driver’s name plus three items that GPS captures automatically: date, time, and location.

In many cases, the same documents and records of duty status can be used to substantiate a deductible expense claim on an income tax return, or distance calculations for fuel taxes reporting (under the International Fuel Tax Agreement) and prorated vehicle registration (International Registration Plan).

The thing to remember is that many electronic log providers automatically delete ELD records after six months.

The Internal Revenue Service suggests that you keep documents to support a business expense claim for seven years.

During auditing of the International Fuel Tax Agreement (IFTA) and International Registration Plan (IRP), auditors may ask for GPS data going back four years for IFTA and five and a half years for IRP. Specifically, an auditor may ask to see raw GPS data to verify the calculated distance on your IFTA or IRP report. When missing GPS points create gaps in distance records, you should be ready to provide the documents—driver logbooks, trip sheets, dispatch records, receipts—necessary to close those gaps and support your claim.

As you consider ELD providers, you’re not just evaluating a device. Ask your provider about access to all the logbook and GPS data you’ll need when an auditor requests them.

3. Cloud Computing

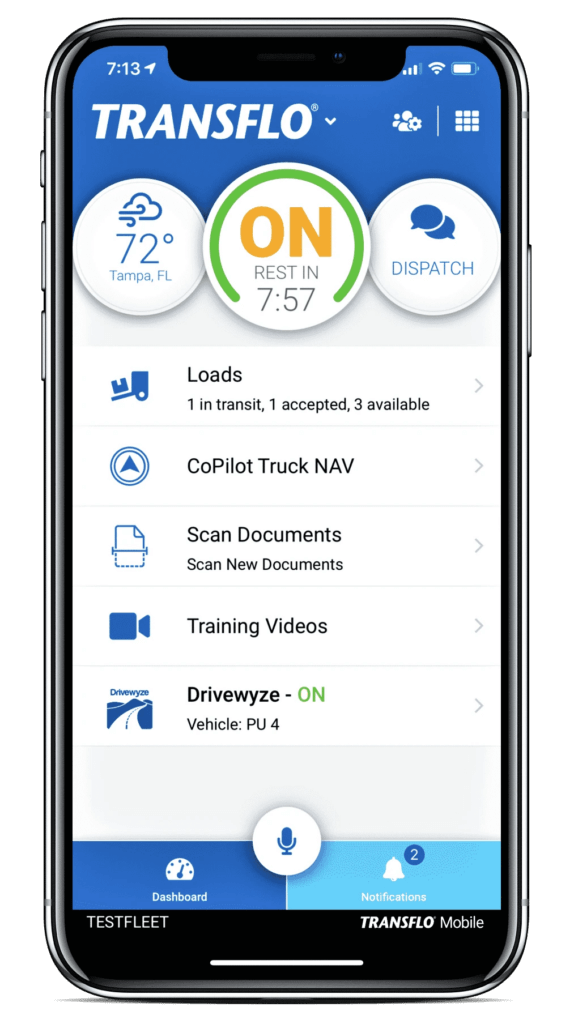

Hours-of-service compliance is about the driver, not the vehicle. So, it would make sense for an ELD solution to use a device that’s with the driver all the time, like a smartphone or tablet.

Can your mobile device be an ELD? FMCSA says yes, as long as it meets the federal requirements. Doing so requires a system that consists of a smartphone or tablet, a mobile app, and a “black box” device that connects to the engine control module through the vehicle’s OBDII port.

What are the pros and cons of using a smartphone versus a dedicated ELD?

Hardwired versus Bluetooth: The smartphone and the black box need to maintain a connection at all times when the vehicle is in use. Wired connections require the driver to remember to physically plug or unplug their phone into the black box. Wireless connections can occasionally drop out, leaving gaps in your log that increase the risk of violations and fines.

Battery life: When the batteries are drained or get too hot, a phone or tablet will shut itself down. One way that device manufacturers save battery power is to restrict apps from running when they’re not actively in use. This can be an issue for ELD apps that run in the background to compile data and make calculations about the driver’s duty status.

Changing technology: Smartphone technology evolves quickly. As mobile device manufacturers come out with new hardware, cables, and operating systems, the black box that’s connected with the ECM in the vehicle may not be able to interface with it any longer.

Stuff happens: If your ELD resides on a phone, the driver needs to understand the consequences of moving the truck when that phone isn’t available because he dropped it on the pavement, left it at home, or the battery died.

Any of these issues can lead to inconsistencies that require a lot of work for the carrier and driver to correct.

Cloud-based computing gives you a way to access data and applications from wherever you need them using a mobile device or desktop computer.

In this case, the black box automatically sends engine and GPS information to a server hosted by the ELD vendor. The app on the mobile device will do the same with information provided by the driver. The cloud-based server handles all of the processing and storage of your ELD data. The phone is simply a convenient user interface.

When there’s a gap in network coverage, the black box and mobile app will continue to collect and store records and, as soon as the vehicle comes into coverage, all the logs sync instantly. Since duty status records are small files, it shouldn’t take a strong signal or a lot of time to transmit data.

As you contemplate your readiness for the final ELD deadline, the shift from paper logbooks to unregulated electronic devices and now to fully compliant ELDs is moving to the cloud.

Cloud-based computing means it’s fully possible to use your smartphone for an ELD, as long as you pick a connected solution that’s reliable, flexible, secure, and comply with federal regulations.