The New F-Word: Fuel

A Story of Shortages and Price Fluctuations

It starts with the turn of the key, and in a flash – potential energy is converted to kinetic energy. A distinct smell of diesel fills the air as professional drivers begin their journey – all thanks to the firing of a few cylinders beneath the hood.

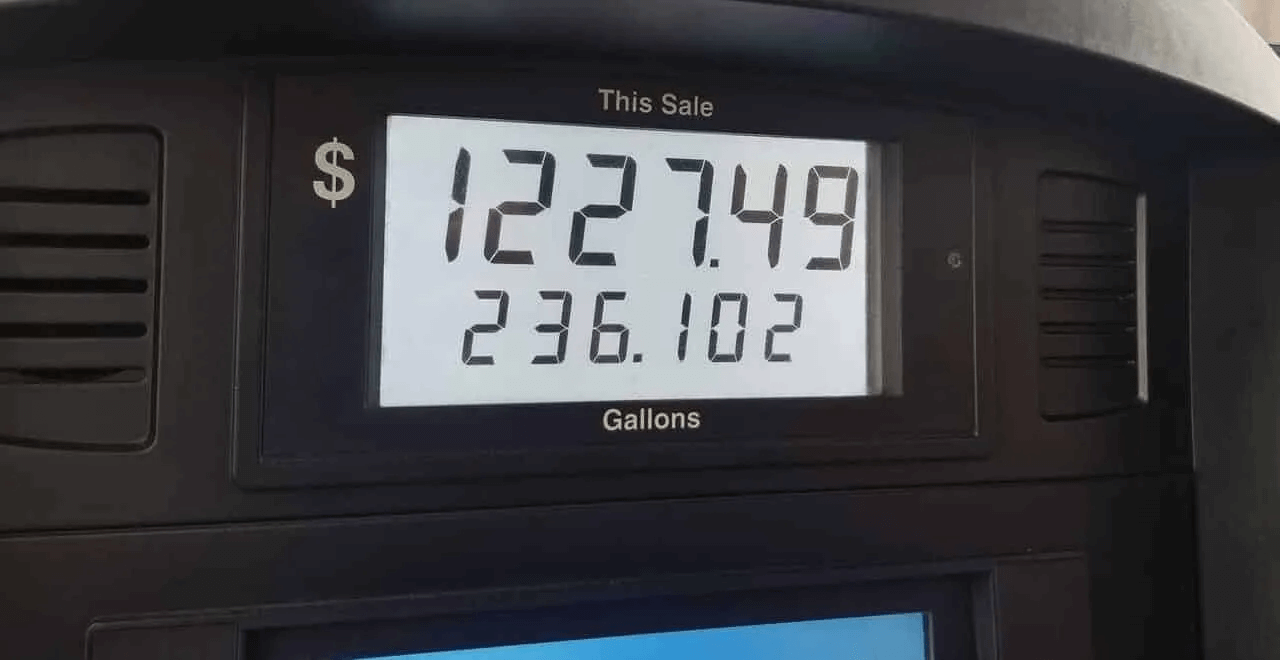

For some drivers today, their journey has stalled due to the increased fuel expenses that seem to worsen each day.

Fuel prices have surged to an all-time high, beating the previous record during the great recession of 2008. As prices increase, the overall operational costs for fleets do too. And in some cases, these increases have halted fleets within the SMB market that failed to keep up. Many that can, are forced to increase rates to maintain themselves.

Sources have described our current state as a domino effect, but realistically it’s more like a snowball effect that rolls beyond trucking, bleeding into the rest of the supply chain.

Together, let’s break this down and see where we are. What is going on? The answer, though uninspiring, seems to revolve around three major points: Supply, Demand, and Inflation.

Let’s start with the elephant in the room, the political turmoil between Russia and Ukraine. Sanctions and embargoes against Russia have caused a swift tightness in the oil market. The United States imports a relatively low percentage of crude oil from Russia, approximately 3%. The reason we see staggering increases is that Russia is one of the largest global suppliers. As other countries search for alternate oil sources, it lowers the supply to the United States but also creates further demand.

[Although ranked third among oil-producing nations, the IEA says that, in terms of all oil products, Russia is the world’s largest exporter to global markets and the second-largest crude oil exporter after Saudi Arabia.] (Source)

One could argue that fuel has always been a volatile commodity, but there’s no denying that the pandemic played a major factor in demand fluctuation. We all saw the chaos as crude oil was listed at a negative price. Remote work was even reported by CNBC as the “biggest threat to oil demand” and now with many returning to (or already transitioned back to) in-person work, demand is steadily increasing.

[“The biggest threat to oil demand is the rise of remote working,” Bernstein said in a recent note to clients. “A decrease in commuting and business air travel is clearly negative for oil demand.”

Gasoline represents a sizable portion of overall oil demand — within each barrel of refined crude about 45% is used for gasoline — and, according to RBC, about 28% of gasoline demand in the U.S. is from people driving to and from work.] (Source)

So, what now? Put simply, watching staggering fuel charges build. This is where we approach the third main aspect – inflation. The relationship between fuel and inflation is (in my opinion) both cause/effect, and cyclical. As the price of fuel increases, it feeds into a larger machine of inflation by raising the operational costs (direct cause). What becomes particularly interesting is how those increases are then passed through the supply chain and into consumer goods, creating and feeding a loop of hyper-inflation.

What about returning to normal? Einstein’s theory of relativity doesn’t only apply to time, but also to the idea of normalcy – what is normal, if not subjective? So, when we posted a survey question in an online transportation industry group about how long it would take for fuel prices to return to normal, a second question arose, “What is normal?” Normal is not based around a specific target for fuel price (although there are analysts who could provide a range). Perhaps in this case normal refers to what fuel costs would look like without a worldwide pandemic and fewer political crises.

Survey results:

Q: How long do you think it will take for fuel costs to adjust to normal?

- 16% believe less than one year

- 44% believe more than one year

- 40% do not think there will be a return to “normal”

*Sample size of 1,152 respondents

What can be done? Regarding fuel prices – not much. The only way to combat the current fuel market is to change how you interact with it, meaning to lower your usage and optimize efficiency. This is easy enough to say but can be quite difficult to achieve. My recommendation is to leverage technology (such as Transflo telematics) that can provide insight into fuel usage, idle times, and vehicle speeds. Using the ability to track those metrics will show how and where you can reduce fuel consumption and ultimately lower operational costs. In the meanwhile, I would prepare for these prices to stick around for at least another 12 months (barring any additional factors).

For more industry news, keep up to date with our blog.